Mayday is the team to call. With years of experience in debris removal, restoration, and remodeling, they’ve built a strong reputation helping Las Vegas locals navigate their insurance losses. In response to the growing number of unlicensed newcomers entering the market, Mayday strategically pivoted and discovered an untapped niche—partnering with real estate brokers and property managers.

Co-owner and project manager Neil May explained, “You’d think decades of experience and professional certifications would be enough, but in today’s market, you need deep pockets just to maintain an online presence. We’ve tried lead services and online ad campaigns, but they don’t guarantee quality leads or paying jobs. It’s really about community connections and getting out there.”

With more than 100 companies advertising similar services, businesses have become easy targets for lead generation firms that often resell the same leads two or three times to different companies.

.

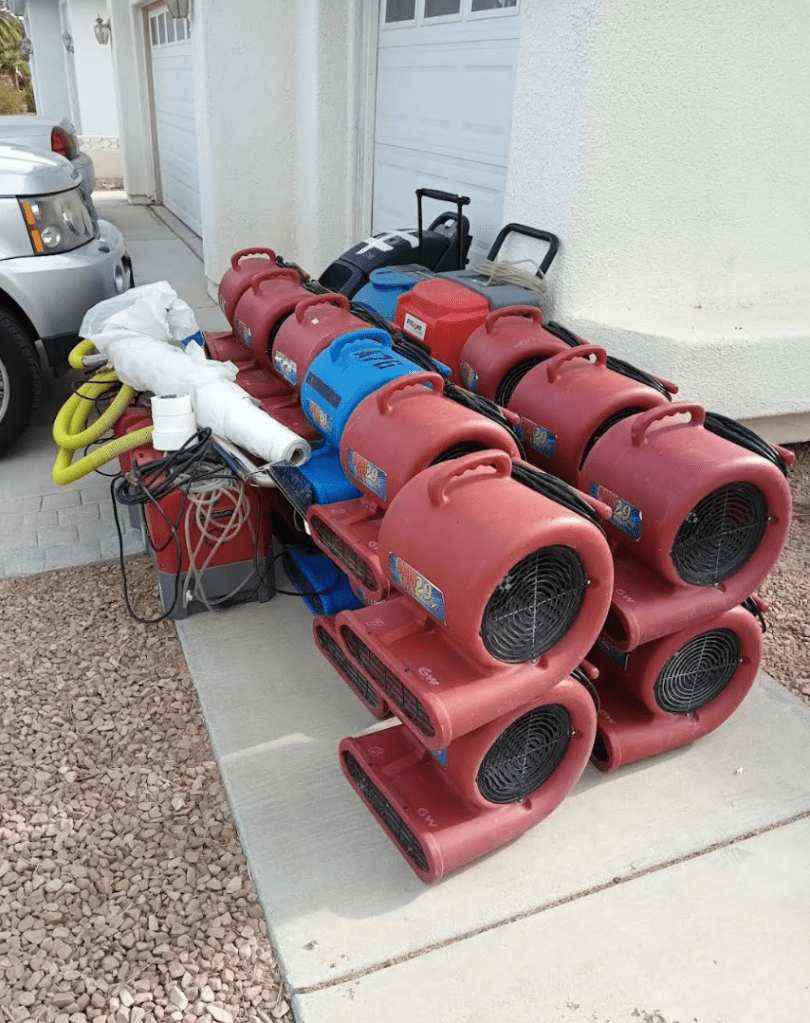

Mayday serves both Clark County and Nye County, with most of their projects located in Las Vegas, Henderson, and Pahrump. According to their data, more than 75% of their work stems from flooding and burst pipes, while the remaining cases are the result of fire damage.

May said he entered the business after inspecting insurance losses and noticing how poorly many mitigation and restoration companies were drying out homes. Incomplete drying, he explained, often left properties vulnerable to mold growth and other hazardous conditions.

May previously worked as a catastrophe insurance adjuster for one of the largest carriers in North America, where he witnessed a significant shift in how carriers train adjusters and handle claim settlements. He noted that many carriers now require customers to use vendors from their in-house programs, with those vendors often taking direction directly from the carriers’ adjusters

May said that the way he counters inappropriate behavior from adjusters is by maintaining certifications in industry standards and staying well-versed in the carriers’ software and workflows.

The insurance industry is changing, and many carriers now threaten to raise rates or even cancel policies when customers file claims. What most people don’t realize, May explained, is that there are more than 20 other companies that would gladly take their business. He added that, in his experience, the more an insurance company advertises, the worse its claim handling tends to be—though the reasons behind that, he noted, are “a whole other story.”